Today we saw both the VIX futures and SP500 futures (ES) rise as the stock market hit new record highs.

SP500 at Record Highs

A spread chart of VIX and ES 1/1 ratio.

Today was the first day VIX H contract trading as the front month. There was a lot of pressure to push up VIX today.

The word in the pit was that there was a large call buyer in VIX betting on a rise to 16 by March.

The front Vix calendar hit a high of 1.94 on Monday and has since been going down, closing at 1.22 today.

High Probability Trade

High probability trade setups and trading strategies for futures, stocks and forex.

Wednesday, February 15, 2017

Wednesday, November 30, 2016

OPEC cuts oil production!

It seems the mass media just can't get it right. First they were wrong about the Brexit vote (Leave!), then the presidential election (Trump!), and now OPEC's decision to cut (Cut!). At one point today Brent Crude futures were trading over 10% on OPEC's decision to cut production by about 1.2 million BPD. This was OPEC's first cut since 2008.

Wednesday, November 09, 2016

Donald Trump won the presidency

Today was a historic day for the United States, with Donald Trump becoming the 45th president of the United States. With almost all of the online presidential polls indicating Hillary was going to win with about 85% odds in her favor(with notable exception Nate Silver) , things were looking like a done deal for Hillary and the Democrats. Things started to change as soon as the voting had stopped in Florida and the tallies started coming in. It was apparent as soon as Trump gained traction in Florida that the market was reacting negatively. As time went on and Trump gained in Indiana and North Carolina the market reacted much more negatively, so much so that ES ultimately touched limit down (-5%). It wasn't until later on in the night after Hillary conceded that the market started to come off the lows. Once Trump gave his victory speech the market went into rally mode and came all the way back to down -30. ES ended the day up 1.11% and the Vix Index was crushed.

It all came down to Florida.

HUGE range for ES. From Limit down (-107 ES pts, to close up 25pts)

Vix crushed as usual. Looks similar to Brexit spike but on a much more condensed time frame.

It all came down to Florida.

HUGE range for ES. From Limit down (-107 ES pts, to close up 25pts)

Vix crushed as usual. Looks similar to Brexit spike but on a much more condensed time frame.

Labels:

Election,

ES,

Event Day,

news,

president,

stock market crash,

trade strategy,

vix

Thursday, August 28, 2014

St. Petersburg paradox

From Wikipedia

"A casino offers a game of chance for a single player in which a fair coin is tossed at each stage. The pot starts at 2 dollars and is doubled every time a head appears. The first time a tail appears, the game ends and the player wins whatever is in the pot. Thus the player wins 2 dollars if a tail appears on the first toss, 4 dollars if a head appears on the first toss and a tail on the second, 8 dollars if a head appears on the first two tosses and a tail on the third, 16 dollars if a head appears on the first three tosses and a tail on the fourth, and so on. In short, the player wins 2k dollars, where k equals number of tosses. What would be a fair price to pay the casino for entering the game?

"A casino offers a game of chance for a single player in which a fair coin is tossed at each stage. The pot starts at 2 dollars and is doubled every time a head appears. The first time a tail appears, the game ends and the player wins whatever is in the pot. Thus the player wins 2 dollars if a tail appears on the first toss, 4 dollars if a head appears on the first toss and a tail on the second, 8 dollars if a head appears on the first two tosses and a tail on the third, 16 dollars if a head appears on the first three tosses and a tail on the fourth, and so on. In short, the player wins 2k dollars, where k equals number of tosses. What would be a fair price to pay the casino for entering the game?

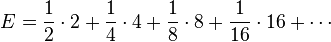

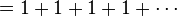

To answer this, we need to consider what would be the average payout: with probability 1/2, the player wins 2 dollars; with probability 1/4 the player wins 4 dollars; with probability 1/8 the player wins 8 dollars, and so on. The expected value is thus

Assuming the game can continue as long as the coin toss results in heads and in particular that the casino has unlimited resources, this sum grows without bound and so the expected win for repeated play is an infinite amount of money. Considering nothing but the expected value of the net change in one's monetary wealth, one should therefore play the game at any price if offered the opportunity. Yet, in published descriptions of the game, many people expressed disbelief in the result. Martin quotes Ian Hacking as saying "few of us would pay even $25 to enter such a game" and says most commentators would agree.[2] The paradox is the discrepancy between what people seem willing to pay to enter the game and the infinite expected value."

Wednesday, May 07, 2014

Explaining Volatility and Levered Drag

Tastytrade had a great video explaining the difference between making bullish bets on VIX, VXX, and UVXY when the VIX index is below 15. To summarize, the 2x leveraged ETF UVXY performed poorly for the long volatility strategy compared to the index and VXX and it was mainly due to volatility drag or more simply, negative compounding due to high volatility over a period of time.

Labels:

educational video,

leveraged ETF,

tastytrade,

UVXY,

vix,

volatility,

VXX

Saturday, November 30, 2013

New Awesome Data Mining website- Quandl

Data Mining for the retail trader just got easier - http://www.quandl.com/

This website has data sets of almost everything.

They even have multiple months of continuous futures contracts.

You can combine all of this data with a variety of different programming languages.

They are even tracking Bitcoin, housing, demographics, and a ton of other subjects.

This website has data sets of almost everything.

They even have multiple months of continuous futures contracts.

You can combine all of this data with a variety of different programming languages.

They are even tracking Bitcoin, housing, demographics, and a ton of other subjects.

Saturday, December 01, 2012

Free Resources to learning R and other coding languages

R project - R is a free software environment for statistical computing and graphics. It compiles and runs on a wide variety of UNIX platforms, Windows and MacOS.

R Studio - RStudio IDE is a powerful and productive user interface for R. It’s free and open source, and works great on Windows, Mac, and Linux.

R Cookbook - Download link to an introductory book to learning R.

R Tutorial Blog - A blog with lots of R tutorials.

Coursera's R course - Recorded R lessons from Coursera on youtube.

R Intro Book - Another great introductory pdf book on R.

Codecademy - Codecademy is the easiest way to learn to code. It's interactive, fun, and you can do it with your friends. They have interactive tutorials on Javascript, HTML/CSS, Python, and Ruby.

R Studio - RStudio IDE is a powerful and productive user interface for R. It’s free and open source, and works great on Windows, Mac, and Linux.

R Cookbook - Download link to an introductory book to learning R.

R Tutorial Blog - A blog with lots of R tutorials.

Coursera's R course - Recorded R lessons from Coursera on youtube.

R Intro Book - Another great introductory pdf book on R.

Codecademy - Codecademy is the easiest way to learn to code. It's interactive, fun, and you can do it with your friends. They have interactive tutorials on Javascript, HTML/CSS, Python, and Ruby.

Labels:

professional traders.,

Programing,

Quant,

R,

Trader Education

Wednesday, October 13, 2010

Automated Trade System From NinjaTrader to Bracket Trader to Interactive Brokers

This is a Video I made showing automated trades being sent from NinjaTrader to Bracket Trader to Interactive Brokers

How to Setup an Automated Trade System From NinjaTrader to ZeroLine Trader

There are several reasons why someone might want to use ZeroLine Trader over NinjaTraders built in Trade Management software. You may like Zeroline Trader's trade management software over Ninjatraders ATM software because it is easy to use and you can customize your strategies in Zeroline Trader to your liking. You may also be using Zeroline Trader over NinjaTrader because you don't want to pay to have to use NinjaTrader but you like the charts and strategies that you've designed. Many people will install NinjaTrader and develop an automated trade system but never go live with it because of the extra fee's it costs to use NinjaTraders Trade management software. If you are client of Interactive Brokers there is a simple way around those fees by using another 3rd party application to manage the trade like ZeroLine Trader.

What you can do is setup an automated trade system in NinjaTrader and instead of using NinjaTrader trade management software, you send an email out to ZeroLine Trader to place the trade for you, and then ZeroLine Trader sends the order to Interactive Brokers. Using the Perl script I've written, and with a little bit of coding, this is a very simple setup and gives you a fully functional automated trade system for Ninjatrader through Interactive Brokers without the extra cost of having to own Ninjatrader or pay the extra cost for placing each trade. Having the automated trade system run directly through Ninjatrader to Interactive Brokers will be slightly faster and may be slightly easier to setup; however, using ZeroLine Trader as a middleman to save on the extra fee's may be worth it.

Here are the Downloads you will need-

NinjaTrader

Charting and Trading Platform

ZeroLine Trader - Trade Management Software

Mailenable - Free Mail Server

ActiveState Perl - Free Scripting Software

HPT's ZeroLine Trader Perl Script - An email client that checks your email and enters a trade into ZeroLine Trader when a new alert is found in NinjaTrader

Interactive Broker’s TWS Demo - A Free Demo account with Interactive Brokers

Visual C++ 2005 from Microsoft -This is software required by the InteractiveBrokers API to register properly

What you can do is setup an automated trade system in NinjaTrader and instead of using NinjaTrader trade management software, you send an email out to ZeroLine Trader to place the trade for you, and then ZeroLine Trader sends the order to Interactive Brokers. Using the Perl script I've written, and with a little bit of coding, this is a very simple setup and gives you a fully functional automated trade system for Ninjatrader through Interactive Brokers without the extra cost of having to own Ninjatrader or pay the extra cost for placing each trade. Having the automated trade system run directly through Ninjatrader to Interactive Brokers will be slightly faster and may be slightly easier to setup; however, using ZeroLine Trader as a middleman to save on the extra fee's may be worth it.

Here are the Downloads you will need-

Charting and Trading Platform

Monday, October 11, 2010

QuoteTracker to ZeroLine Trader Automated Trade System

I have written a perl script which enables you to make automated trades based off of signals generated in Quotetracker.(Thanks to Boogster for the original script)

This automated Trade System works the same way my Bracket Trader Automated System for QuoteTracker works, so I have made 1 video detailing how to setup Zeroline Trader to enable automated trades. I Like Zeroline Trader over Bracket Trader for the Automated Trade system because Zeroline Trader has more options to configure strategies and you can setup the automated trade system to trade multiple symbols very easily.

Here are some Tips-

Make Sure your Page is named "Futures" in ZeroLine Trader and your email template is setup to trade the Contract based on the Data Row ID in ZeroLine Trader

How to setup the Order Email template in QuoteTracker-

For reference on how to setup the ATS, you may want to watch my other videos.

Boogster made a very detailed post on how to make an ATS and I decided to make a tutorial video following his guide. If you have a broker that accepts API connections like Interactive Brokers, then you can make this Automated Trading System for Free. Here are the downloads you'll need-

Medved Quotetracker - Free Charting Software

ZeroLine Trader - Trade Management Software

Mailenable - Free Mail Server

ActiveState Perl - Free Scripting Software

HPT's ZeroLine Trader Perl Script - An email client that checks your email and enters a trade into ZeroLine Trader when a new alert is found in QuoteTracker

Interactive Broker’s TWS Demo - A Free Demo account with Interactive Brokers

Visual C++ 2005 from Microsoft -This is software required by the InteractiveBrokers API to register properly

The Videos below were made as a tutorial for setting up QuoteTracker to Bracket Trader as a complete Tutorial. If you had trouble getting the ATS to work for ZeroLine Trader, these other Tutorial videos I made for Bracket Trader ATS may help you, as the only difference between the ATS between the two applications is the Order configuration and Perl Script. The old Perl Script used for BracketTrader will not work for ZeroLine Trader, you must download the new one above.

HPT's ATS Tutorial Part 1 - Downloading Software Setup

Part 2 - Installing and Configuring software

Part 3 - Setting up Quotetracker & ATS Email Tempelate

Part 4 - Bracket Trader Setup & Live Trade

Part 5 - ATS Exit Signals & IB Demo Account

Example of ATS Exit signal working

I would like to give a special thanks to Boogster for his work on the ATS perl script, Jerry for his awesome charting software QuoteTracker, and Hong for his excellent Trade Management software ZeroLine Trader.

This automated Trade System works the same way my Bracket Trader Automated System for QuoteTracker works, so I have made 1 video detailing how to setup Zeroline Trader to enable automated trades. I Like Zeroline Trader over Bracket Trader for the Automated Trade system because Zeroline Trader has more options to configure strategies and you can setup the automated trade system to trade multiple symbols very easily.

Here are some Tips-

Make Sure your Page is named "Futures" in ZeroLine Trader and your email template is setup to trade the Contract based on the Data Row ID in ZeroLine Trader

How to setup the Order Email template in QuoteTracker-

For reference on how to setup the ATS, you may want to watch my other videos.

Boogster made a very detailed post on how to make an ATS and I decided to make a tutorial video following his guide. If you have a broker that accepts API connections like Interactive Brokers, then you can make this Automated Trading System for Free. Here are the downloads you'll need-

The Videos below were made as a tutorial for setting up QuoteTracker to Bracket Trader as a complete Tutorial. If you had trouble getting the ATS to work for ZeroLine Trader, these other Tutorial videos I made for Bracket Trader ATS may help you, as the only difference between the ATS between the two applications is the Order configuration and Perl Script. The old Perl Script used for BracketTrader will not work for ZeroLine Trader, you must download the new one above.

HPT's ATS Tutorial Part 1 - Downloading Software Setup

Part 2 - Installing and Configuring software

Part 3 - Setting up Quotetracker & ATS Email Tempelate

Part 4 - Bracket Trader Setup & Live Trade

Part 5 - ATS Exit Signals & IB Demo Account

Example of ATS Exit signal working

I would like to give a special thanks to Boogster for his work on the ATS perl script, Jerry for his awesome charting software QuoteTracker, and Hong for his excellent Trade Management software ZeroLine Trader.

Monday, May 31, 2010

How to Reduce your CME Futures Commissions

If you are a serious Futures Trader that trades ES, NQ, YM, or any other CME, CBOT, or NYMEX product, then you have the ability to save thousands if not more per year by obtaining an Exchange membership depending on the amount of volume you trade per day.

Checkout the Video and Spreadsheet provided.

CME Fee Reduction Spreadsheet

CME Membership Webpage

CME Fee Schedule

Checkout the Video and Spreadsheet provided.

CME Fee Reduction Spreadsheet

CME Membership Webpage

CME Fee Schedule

Wednesday, March 04, 2009

FDIC failed bank list chart

It's only been a month since I last posted the FDIC failed bank list and the month of February we saw the largest monthly increase in failed banks(10 banks). The FDIC has a detailed list of all the failed banks.

Subscribe to:

Posts (Atom)